Realist Tax is a CRMLS core product that provides in-depth tax record information for properties, including sales history and basic property information (square footage, number of beds and baths, etc.). You can build and share a Comparative Market Analysis (CMA) report directly in Realist Tax by following the steps below.

From the Realist Tax homepage, use the Search by address bar to find the subject property.

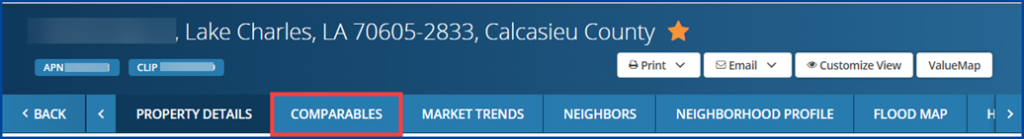

Click the Comparables tab.

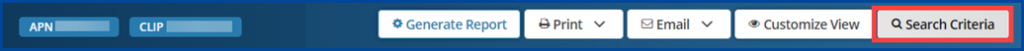

The system will automatically try to find at least 20 recently closed comparables from the MLS. You can click Search Criteria at the top right to manage filters and expand the comparables search.

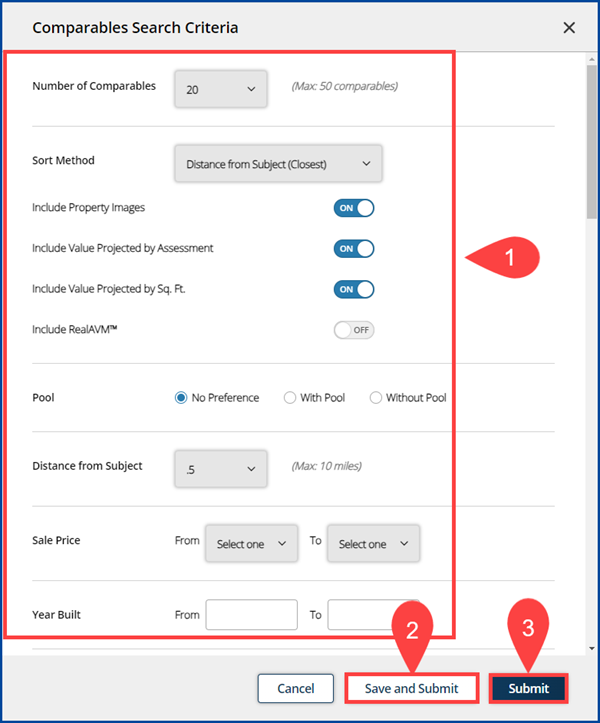

A pop-up will appear:

- Scroll through the list of available filters and adjust as needed

- Choose Save and Submit to save these filters for future use, or

- Choose Submit to apply these filters to this comparable search only

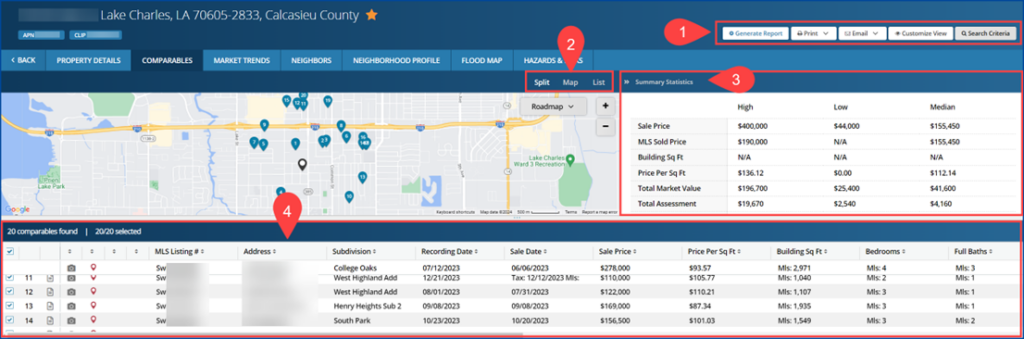

Below is the Comparables section layout:

- Action Items at top right

- View Options to minimize/maximize your workspace

- View/Hide Summary Statistics provides insights on the comparables analysis

- List View lets you research and manage the included comparables

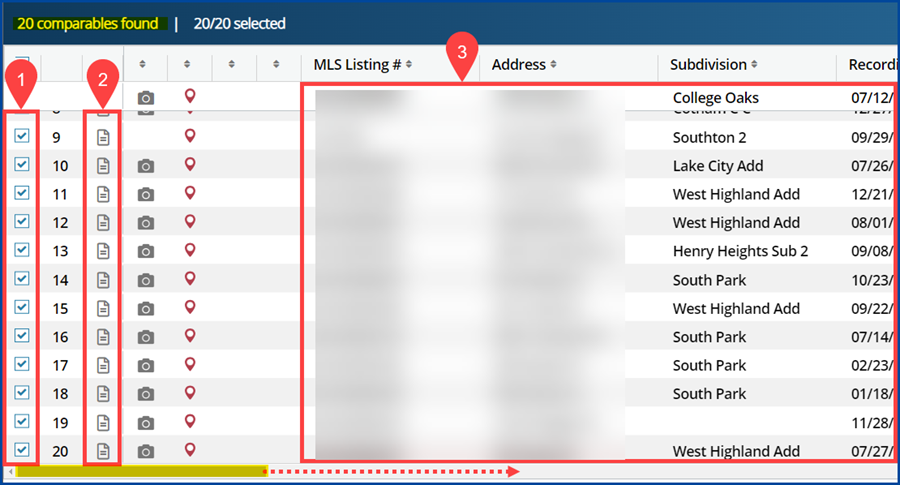

To manage and research selected comps from the List View:

- Check or uncheck the box to add or remove a comp from the report

- Select the document icon to view the comparable property details

- Scroll right through the list view to see additional facts about the comps

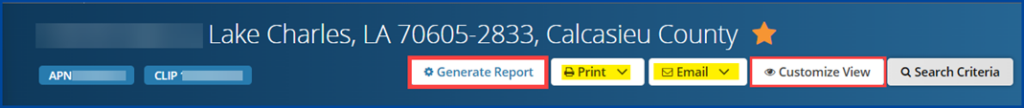

To create a report, select Generate Report in the action items.

Note: Click Customize View to remove any sections that you do not want to include in the report.

Once you have generated a CMA report you are satisfied with, you can select Print or Email to share this report.